BlackRock introduces Alphaagents: Advancing stock portfolio structure through multi-agent LLM collaboration

The use of artificial intelligence (AI) in the financial market is developing rapidly, and large language models (LLMS) are increasingly used in stock analysis, portfolio management and stock selection. BlackRock research team proposed letters for investment research. The Alphaagents framework leverages the power of multi-agent systems to improve investment outcomes, reduce cognitive biases, and enhance decision-making processes in stock portfolio construction.

The demand for multi-agent systems in stock research

Traditionally, stock portfolio management relies on human analysts combining huge, diverse data sets (financial statements, news reports, market indicators, etc.) for wise stock selection. This process is susceptible to cognitive and behavioral biases such as loss of aversion and overconfidence, which are well documented in the behavioral finance literature.

LLM can quickly process large amounts of unstructured data, thereby extracting actionable insights from sources such as regulatory disclosures, revenue calls, and analyst ratings. But even powerful models face challenges:

- Hallucination: Generate reasonable information that is not yet clear.

- Limited domain focus: Strange agents may ignore the contrasting point of view or fail to consider the interaction of market sentiment, fundamental analysis and valuation.

- Cognitive bias mitigation: Reduce human bias in automated decision making.

The multi-agent LLM framework is designed to address these pitfalls through collaborative reasoning, debate and consensus.

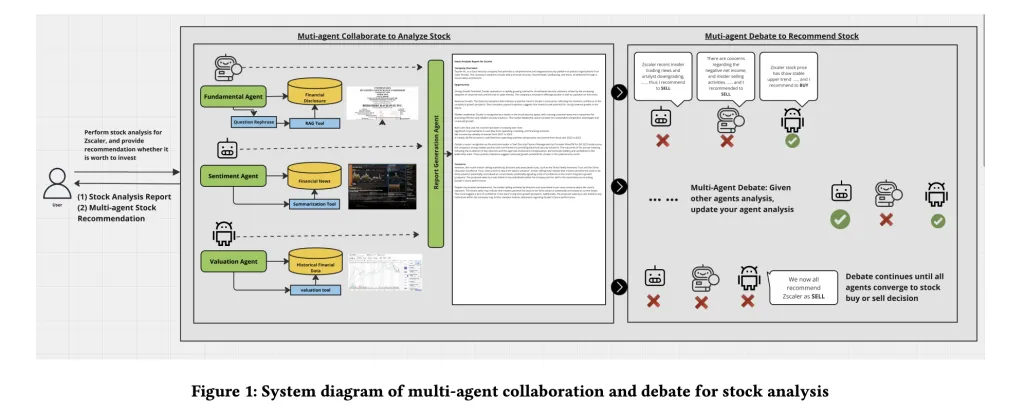

Alphaagents framework: system architecture

Alphaagents is a modular framework designed to select stock inventory, with three core professional agents, each representing a unique analytical discipline:

1. Basic Agent

- Function: Use 10-K/10-Q documents, departmental trends and financial statements to automatically conduct qualitative and quantitative analysis of company fundamentals.

- tool: Wipes (retrieval effect generation) are used for report analysis, extracting data directly from files and timely engineering in specific fields.

2. Emotional Agent

- Function: Analyze financial news, analyst ratings, execution changes and insider trading disclosures to measure the impact of market sentiment on stock prices.

- tool: LLM-based summary and reflex enhancement tips that drive wise advice and emotional classification.

3. Evaluation Agent

- Function: Evaluate historical stock prices and quantities to determine valuations, calculate annual returns/volatility and evaluate pricing trends.

- tool: Computational analysis for fluctuation and return calculations with the help of strict mathematical tool constraints.

Each agent runs on data specifically approved for their designated roles, minimizing cross-domain pollution.

Role Tips and Agent Workflow

Alphaagents adopts “role tips” to carefully produce agent instructions consistent with expertise in the financial field. For example, evaluating agents are prompted to focus on long-term price and quantity trends, while emotional agents combine news-driven market responses.

Coordination is managed by the Group Chat Assistant (based on Microsoft Autogen), which ensures fair participation and solidifies proxy output. In the case of divergent analysis or suggestions, the “multi-agent debate” mechanism (circular mechanism style) enables agents to share perspectives and iterate into consensus, a process designed to reduce hallucinations and enhance explanatory.

Converged risk tolerance

Alphaagents modeled agent-specific risk tolerance through timely engineering, mimicking the true investor profile – risk-neutral and risk aversion. For example:

- Risk-avoiding agent: Narrow stock options that emphasize low volatility and financial stability.

- Risk neutral drugs: A wider choice, balance upward potential with caution in measuring.

This allows a tailored portfolio structure to reflect different investment mandates, a novel aspect that has not been widely embedded in previous multi-agent financial systems.

Evaluate and perform backtesting

1. Search Results (RAG) Indicators

Arphaagents uses search metrics to evaluate loyalty and relevance of agent outputs, and uses agents that rely on rags and summaries (e.g., basic and emotional agents) to evaluate metrics.

2. Post-Port Test

The critical downstream evaluation involves an anti-test proxy-driven portfolio of benchmarks over the four-month window.

The portfolios built include:

- Evaluate the agent portfolio

- Basic Agent Portfolio

- Emotional Agent Portfolio (in sufficient news coverage)

- Coordinated multi-agent portfolio

Performance metrics:

- Cumulative returns

- Risk-adjusted returns (Sharpe ratio)

- Rolling Sharpe ratios are used for dynamic risk assessment

The survey results reveal:

- Risk neutral situation: Multi-institutional collaboration outperforms a single agency approach and market benchmarks, synergizes short-term sentiment/valuation and long-term fundamental perspectives.

- Risk avoidance situation: All agent-driven portfolios are more conservative, lagging behind the benchmark due to tech industry gatherings and lower volatility exposure. However, a multi-mechanical approach can achieve lower shrinkage and better risk mitigation.

Key insights and practical implications

- The multi-agent LLM framework brings reliable, interpretable reasoning to inventory selection and has modularity (e.g., technical analysis, macroeconomic agent) for expanding and integrating new agent types.

- The debate mechanism echoes the workflow of the investment committee in the real world, reconciling different perspectives of transparent decision-making, a key feature of institutional adoption.

- Alphaagents is used not only for portfolio construction, but also for modular inputs of advanced optimization engines (means, black columnists), expanding use cases in modern asset management.

- Human Transparency: All agent discussion logs are reviewable, providing coverage and audit capabilities that are critical to organizational trust.

in conclusion

Alphaagents represent a compelling advancement in agency portfolio management: collaborative multi-agent LLM, modular architecture, risk-aware reasoning, and rigorous assessment. Although the current scope is centered on stock selection, the potential of automated, interpretable and scalable portfolio management is clear, positioning the multi-agent framework as the underlying component in future financial AI systems.

Check Paper. Check out ours anytime Tutorials, codes and notebooks for github pages. Also, please stay tuned for us twitter And don’t forget to join us 100K+ ml reddit And subscribe Our newsletter.

Michal Sutter is a data science professional with a master’s degree in data science from the University of Padua. With a solid foundation in statistical analysis, machine learning, and data engineering, Michal excels in transforming complex datasets into actionable insights.